fsa health care limit 2022

NurseStat is looking for a Long Term Travel Home Health Home Care RN in Medford NY. The health FSA contribution limit is established annually and adjusted for inflation.

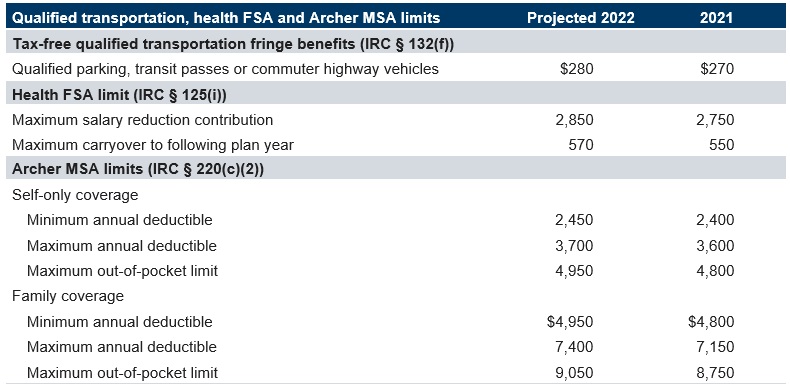

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Learn more from GoodRx about the increase in FSA contribution.

. Island Health Care Associates. Shop Now To Save More. Get a free demo.

Health FSA maximum carryover of unused amounts 570year. With a Health Care FSA you use pre-tax dollars to pay for qualified out-of-pocket Health Care expenses. The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year.

As a result the IRS has revised contribution limits for 2022. If you have adopted a 570 rollover for the health care FSA in 2022 any amount that rolls over into the 2023 plan year does not affect the maximum limit that employees can contribute. It also includes annual inflation-adjusted numbers for 2022 for a number of other tax provisions.

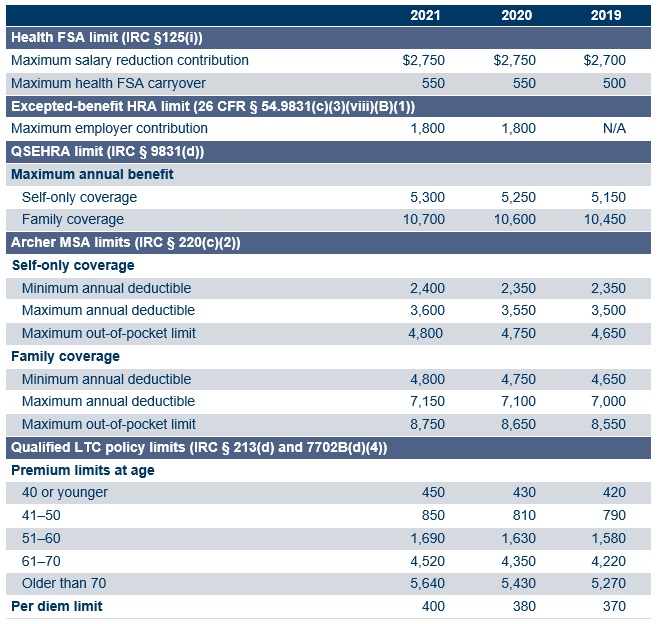

FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. TIAA HSA Offers The Flexibility Portability Needed To Fit Your Future. 125i IRS Revenue Procedure 2020-45.

Healthcare Healthy Living Store. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. For 2022 the maximum amount that can be contributed to a dependent care account is 5000.

Qualified Small Employer HRA QSEHRA increases to 5450year for single. Health FSA Carryover Maximum. Employers should communicate their 2022 limit to their employees as part of the open enrollment process.

21-45 also increases the carryover limit for a health FSA to 570. Ad Custom benefits solutions for your business needs. The money you contribute to a Health Care FSA is not subject to payroll taxes so you end up paying less in.

The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. This is a 13 week. Employees can elect up to the IRS limit and still receive the employer contribution in addition.

Free fast and easy way find a job of 793000 postings in Medford NY and other big cities in USA. The 2022 limits for. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

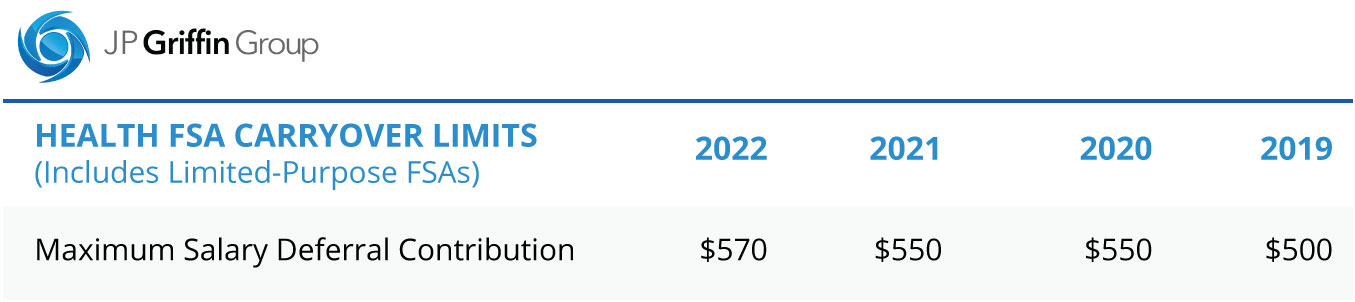

The health FSA dollar. Thus 2750 is the limit each employee may make per plan year regardless of the number of other individuals spouse dependent etc whose medical expenses are reimbursable under the employees Health Care FSA. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

Clear a drug screenbackground check This position begins on 06202022 and ends on 12192022 Benefits. 3 rows the chart below shows the adjustment in health fsa contribution limits for 2022The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately. FSAs only have one limit for individual and family health plan participation but.

For the 2021 income year it is 2750 26 USC. Search and apply for the latest Health policy jobs in Medford NY. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022.

Dependent Care Assistance Plans Dependent Care FSA annual maximum if married filing separately. Carry over up to 57000 from one plan year to the next when you re-enroll in a Health Care FSA - theres virtually no risk of losing your hard-earned money How You Save. Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022.

Dependent Care Assistance Plans Dependent Care FSA annual maximum unless married filing separately. Health FSA including a Limited Purpose Health FSA 2 850 year. Employers should ensure that their health FSAs will not allow employees to.

1647 ROUTE 112 Medford NY 11763. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. Elevate your health benefits.

Full-time temporary and part-time jobs. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. And if an employers plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up.

Qualified Parking plans 280 month. On Wednesday November 10 2021 the Internal Revenue Service IRS released Revenue Procedure 2021-45 which officially increased the maximum Health Flexible Spending Account FSA contribution limit to 2850 for calendar year 2022. Employers may continue to impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACAs maximum.

Excepted Benefit HRA remains 1800year. This is an increase of 100 from the 2021 contribution limits. Family Medicine Physician Assistant PA 5 Providers.

Easy implementation and comprehensive employee education available 247. 5 days ago RN Registered Nurse. Ad Add TIAA HSA To Your Qualified Health Plan Today.

Qualified Transportation plans 280month. Vision flexible spending account health savings account. The contribution limit is 2850 up from 2750 in 2021.

This is a 100 increase from the 2021 health FSA limit of 2750. The 2750 contribution limit applies on an employee-by-employee basis. The American Rescue Plan Act and IRS Notice 2021-26 allowed employers to increase the limit of.

1-866-247-5678 Fidelis Care New York. 6 rows 2022 Health FSA Contribution Cap Rises to 2850 SHRM Online November 2021. The allowable amount of carry-over for FSA plans that have adopted a carry-over provision has been increased to 570.

Ad Largest Selection Of FSA Eligible Health And Wellness Products Easy Buy Health Supplies. Dependent Care Fsa Limit 2022 Hce.

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

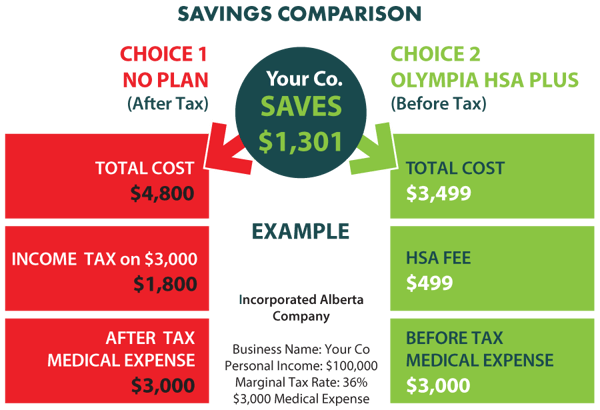

How Does A Health Spending Account Work For Small Business In Canada

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

Flexible Spending Account Vs Health Savings Account Which Is Better

Flexible Spending Accounts Department Of Administrative Services

Flexible Spending Account Contribution Limits For 2022 Goodrx

What Is A Health Care Spending Account In Canada

Hra Vs Fsa See The Benefits Of Each Wex Inc

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Best Health Insurance Companies 2022 Top Ten Reviews

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Healthcare Spending Account In Ontario The Benefits Trust

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Accounts Ensign Benefits

How Does A Health Spending Account Work For Small Business In Canada

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Percentage Of Health Insurance Employers Pay Costs More

Cocomelon Toothbrush In 2022 Brush Teeth Kids Brushing Teeth Sonic Toothbrush